Introduction

Every firm seeks out professional bookkeeping services because they have to work with several entrepreneurs in a variety of industries all over the world. Because it’s a headache to you what to handle your bookkeeping, how put it. And there is scientific proof for it!

A bookkeeper will make ensure that all a company’s accounts are current and accurate. Additionally, they will provide regular updates on those accounts so the directors and owners are aware of their financial situation. Tidy accounts make it simple for auditors. They intervene and take action at the conclusion of the economic year.

What are Professional Bookkeeping Services?

The act of recording and monitoring cash activities for a company is Professional Bookkeeping Services. The bookkeepers must document your business’s activities in accounting results.

There are many different bookkeeping companies. Anyone may put up a sign today and claim to offer expert financial services.

How can you tell if the bookkeeping services you’re using will help your company not survive but also expand? You are passing up an ability to make your economy work for you if your company isn’t growing.

bookkeeping services can benefit your company in a variety of ways, making it function more with savings made for you, first. It can be time-consuming to maintain your records, send out invoices to clients, write checks to suppliers and other debtors, and follow all local, regional, and local filing obligations for your company.

TD Bank survey favored the task even more than 500 owners of small enterprises. So, entrepreneurs are ready to delegate this abhorrent chore to someone else. It’s comparable to how, if we could afford to, the majority of us would be happy to hire an employee. The company task that no one enjoys performing but that everyone needs to do is bookkeeping.

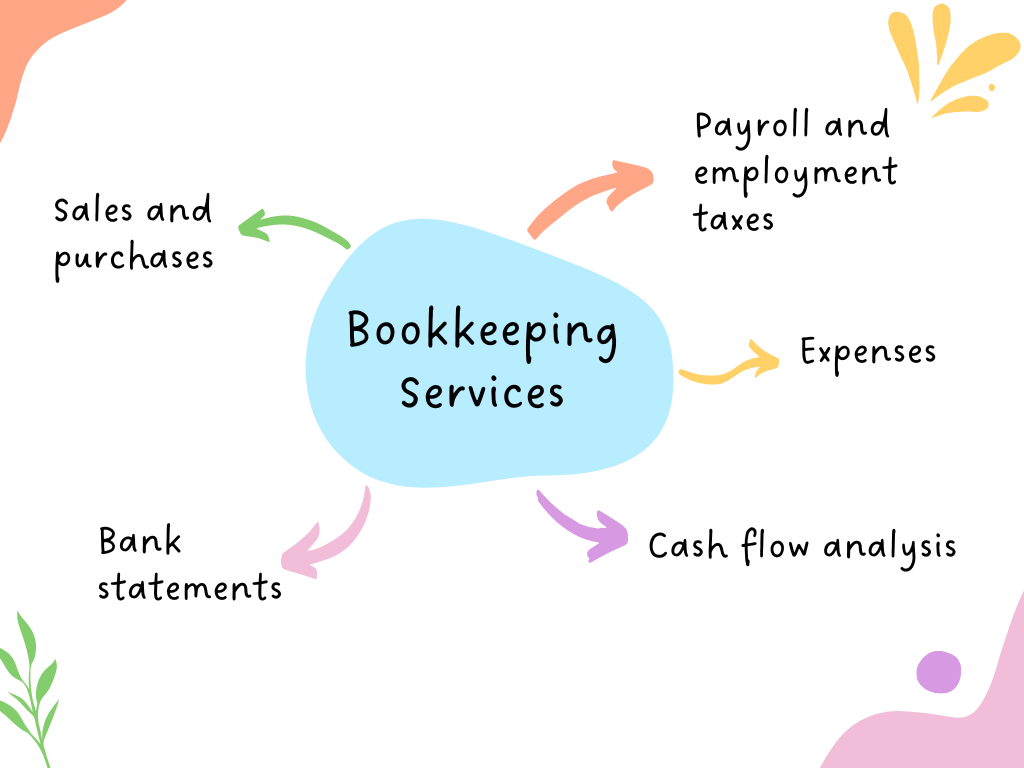

Bookkeeping Services

Maintaining accurate corporate documents is crucial.

It can also assist you in tracking your company’s progress and locating revenue streams.

The records listed below should be exact and organized:

- Bank statements

- Cash flow analysis

- Payroll and employment taxes

- Expenses

- Sales and purchases

Benefits of Bookkeeping Services

We’ll concentrate on the four primary benefits in this section: you’ll save time, and cash, experience less worry, and get professional advice.

1. It makes life easier.

Hours are one of your greatest significant resources as an entrepreneur, and if you’re handling your personal bookkeeping, it’s likely that you’re squandering a lot of it.

You may anticipate saving a least 4–20 hours per month once you outsource your bookkeeping, according to Invensis Technologies. This is due to the fact that a professional bookkeeper having years of expertise and training can complete the task much more than you could.

Think about what you might accomplish with an additional 10 hours every month. Would you repurpose that time to work on marketing?

2. Reduces Costs

Whether you prefer it or not, hiring a company like ours for professional bookkeeping services actually results in financial savings over time. This is why.

To begin with, if you don’t have accounting experience, you’re undoubtedly committing a lot of inefficiencies, the most prevalent of which is misclassifying expenditure.

Misclassifying costs you tax benefits, and we’re not talking about pennies and loose change! Because they didn’t know how to classify expenses, entrepreneurs have missed out on hundreds (and even hundreds!) of USD in tax deductions.

Making the costly error of falling behind. It can appear innocent, but it isn’t.

If you fall behind everyone else in your bookkeeping, you won’t be able to identify and address inconsistencies as they arise.

3. Reduced Stress

You may be surprised to learn that trying to manage your own bookkeeping even without the necessary skills or training can trigger fear, headaches, and high blood pressure.

By the way, this is not an official study. We are basing our decisions on what our consumers have said.

No, but get a bookkeeper if you want full peace of mind. Later on, you’ll thank us.

Online bookkeeping services include automatic time-saving solutions like payroll, taxes, billing, and more. We give you the ability to control your daily cost and revenue for your company. As a result, you may concentrate your efforts on managing your main line of business instead of handling paperwork. We offer smooth, rapid access to your funds over any internet access.

We can assist if you’re sick of calculators and statistics. Our online bookkeeping solutions are tailored to your company’s requirements. We are aware that time is money when running a small business. Because of this, we offer digital bookkeeping with a flexible, affordable, seamless method.

Bookkeeping Services Cost

You can uncover bookkeepers working at all different price ranges and producing all different kinds of outcomes. However, there are currently several innovative pricing strategies that make hiring a consultant possible without posing a significant financial risk.

Practices frequently charge a fixed amount for a particular service or a mix of services. No matter how long it takes to do the assignment, the price remains the same. It reduces some of the customary ambiguity surrounding hourly billing.

Premium account: Other procedures package and provide resources for a set monthly fee. It makes setting up a spending plan for bookkeeping considerably easier.

Bookkeeping Tools For Your Business

Numerous bookkeeper applications provide a selection of tools that are sufficiently different so you may choose the one that works best for your company.

The list of the top 5 bookkeeping tools is designed, in particular, to aid entrepreneurs who must manage a large number of clients and payments. Through the specified bookkeeping software, they may easily monitor sales data, cash past-due checks, and even serve new clients.

1. QuickBooks

One of the greatest bookkeeping tools is QuickBooks, which has bookkeeping features perfect for micro businesses. The certified and electronic versions make it simpler to meet your company’s financial goals. You get instant access to information about buyers, sellers, and employees, as the app’s name suggests.

Pricing

QuickBooks has a $15 monthly minimum purchase price. They do not provide a free version, but if you purchase the online edition, you can receive a 30-day trial with free services and improvements.

2. FreshBooks

Cloud-based accounting tool called FreshBooks makes it simple for entrepreneurs, accountants, and in particular bookkeepers who offer their services to companies of all types, including sole proprietorships and small and medium-sized enterprises.

It’s a great tool for tracking client spending and forecasting market changes as well.

Additionally, it makes it simple for clients to keep track of their income and outgoing costs, enabling them to produce annual tax projections or income reports customized to their firms’ needs.

Pricing

Pricing for Freshbooks starts at $4.50 per month.

3. Xero

Unlike QuickBooks, which began with a desktop edition, Xero has always promoted the cloud. For Mac users who can’t locate what they’re searching for in QuickBooks on Windows, Xero is the first option. Xero offers more than 600 connections and 24/7 live chat assistance for no additional charge, making it simpler for entrepreneurs to handle stock, accounting, and many other tasks.

The most notable aspect of Xero is its ability to track the time and funds spent on particular projects and allow you to easily manage both.

Pricing

Plans start at $22 monthly

4. Botkeeper

Botkeeper, which successfully provides automatic bookkeeping support for businesses by using a fantastic blend of skilled accountants along with ai technology (AI) and deep learning, can be fairly referred to as the era of accounting.

Clients at bookkeeper receive unlimited reporting, beautiful panel boards, and 24/7 provide customers in addition to an unbelievable comprehension of the earnings reports.

Pricing

The pricing for Botkeeper starts at $99.00 a month, which is quite a bit expensive. Bookkeeper offers a free demo, however, unlike many others, they do not offer a free option.

5. Traxit

A workflow automation tool called Traxit enables entrepreneurs to control any activity by leading, overseeing, distributing, and providing feedback.

Navigate the control panel with ease to get the perfect basic outline and quickly make decisions for your company. Establish a plan and check its status, taking into account all the requirements for tax filings and bookkeeping.

Pricing

Pricing for Traxit starts at $50.00 per month. Traxit offers a free trial even though they don’t have a free version.

Professional Bookkeeping Service Pasadena

Perhaps small mistakes can add up. Our bookkeeping service Pasadena CA can keep your books organized so you and your business can concentrate on what you do best. Without the expense of a full-time CPA, the bookkeepers at Coastal Tax Pros will assist you in the process of maintaining your bookkeeping current, from resources to debts.

Our accounting experts are aware of the requirements for creating a solid company foundation. You supply the passion, and Western Taxes Pros bookkeepers in Pasadena will guide you along the path with the necessary knowledge.

We have qualified accountants on staff that keep everything functioning smoothly. We’ll provide you with precise and logical accounting information so you can make smart business decisions.

Professional Bookkeeping Services NYC

There are a ton of small companies in New York City that act as a foundation for the neighborhoods they service. Ninety-eight percent of the town’s over 200,000 enterprises employ less than 100 people, while 89 percent are categorized as absolutely tiny, meaning they employ fewer than twenty people. These companies frequently have problems with record keeping. Thankfully, there are small-business accounting services available to assist these businesses with their financial documentation.

Professional Bookkeeping Services in Miami

Business is expanding for many enterprises in Miami’s warm climate, and life is good by the ocean. The Magic Location, which Forbes ranked as the best city for expanding local firms in 2019, can greatly benefit from professional bookkeeping services.

Considerations for bookkeeping include regular bookkeeping, payables, receivable accounts, tax planning, employment, and reconciling banks, to name a few.

It’s critical to recognize the type of bookkeeping support your company needs to keep it moving in the direction of success.

Search and browse the best bookkeepers in Miami to find one who meets your needs when the time arrives to hire a trustworthy bookkeeper.

Conclusion

Bookkeepers aid companies in maintaining accurate accounting records. Accountants and industry experts can use these files to produce profits statements, file tax forms, and assess the organization’s health.

A bookkeeper may reduce the amount of effort and worry spent by a business owner. Entrepreneurs struggle with maintaining detailed records. Because they don’t know which public blockchains to keep records beneath. Or they don’t have the time to devote to tracking their income and expenses every day. Particularly those who have no financial expertise. Small business bookkeeping services can relieve owners. And directors of these time-consuming duties. So they can devote more of their time to expanding their company.

You can be losing time & expense if you manage a company and don’t use bookkeeping services. In New York State in 2018, the typical earnings for a self-employed person with an incorporated firm were $52,335. Besides several other advantages, using proper bookkeeping procedures. And receiving sound guidance from an auditor can help firms save a significant amount on taxes.